PCIDSS

- (0 Reviews)

- 8 students enrolled

PCIDSS

Introduction: Protecting Cardholder Data with PCI Security Standards

- (0 Reviews)

- 8 students enrolled

Requirements

- ppt

Description

The twentieth century U.S. criminal Willie Sutton was said to rob banks because “that’s where themoney is.” The same motivation in our digital age makes merchants the new target for financial fraud.Occasionally lax security by some merchants enables criminals to easily steal and use personal consumerfinancial information from payment card transactions and processing systems.It’s a serious problem – more than 10.9 billion records with sensitive information have been breachedaccording to public disclosures between January 2005 and July 2018, according to PrivacyRights.org.As you are a key participant in payment card transactions, it is imperative that you use standard securityprocedures and technologies to thwart theft of cardholder data.Merchant-based vulnerabilities may appear almost anywhere in the card-processing ecosystemincluding:• point-of-sale devices;• mobile devices, personal computers or servers;• wireless hotspots;• web shopping applications;• paper-based storage systems;• the transmission of cardholder data to service providers;• in remote access connections.Vulnerabilities may also extend to systems operated by service providers and acquirers, which are thefinancial institutions that initiate and maintain the relationships with merchants that accept paymentcards (see diagram on page 5).Compliance with the PCI DSS helps to alleviate these vulnerabilities and protect cardholder data.

Recent Courses

- January, 29th 2026

- 7

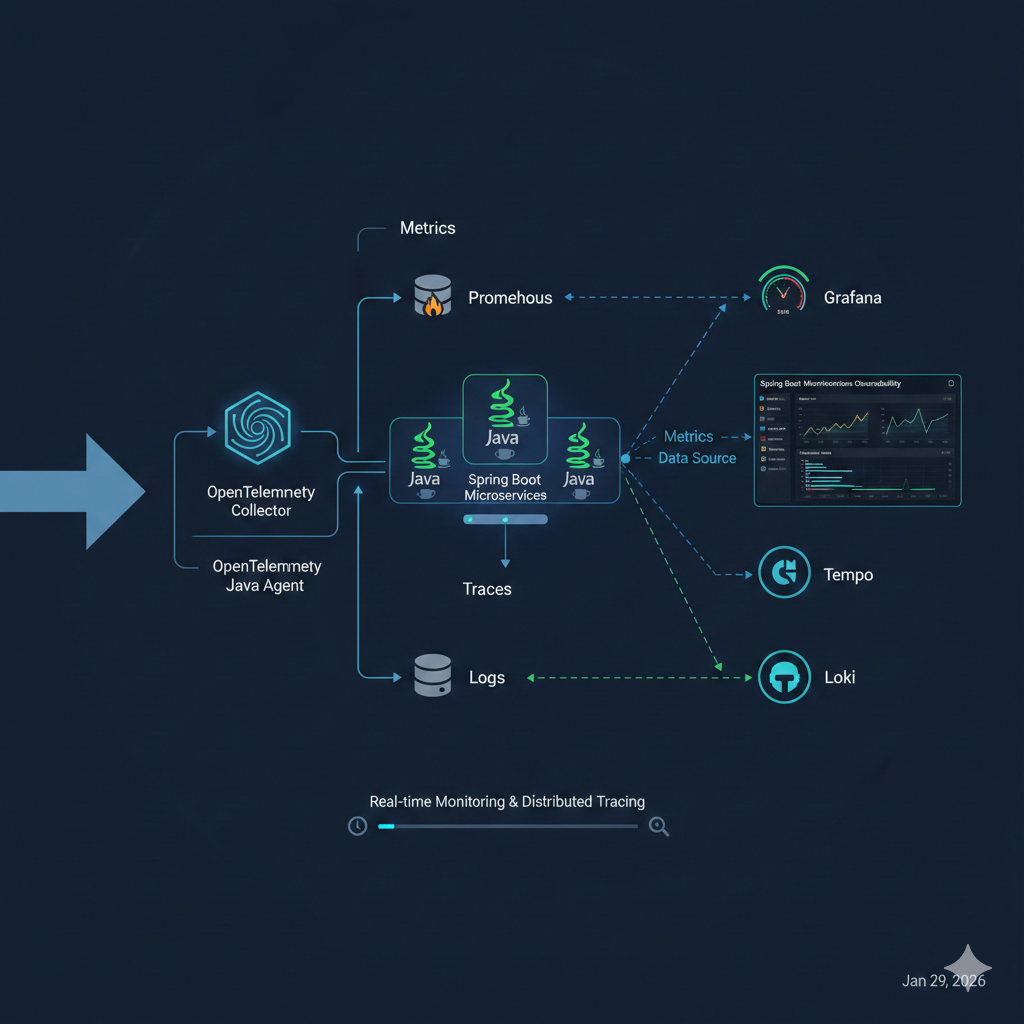

This training introduces Prometheus and Grafana, two core tools for modern monitoring and observability.

- Free

- January, 19th 2026

- 13

An introductory guide to Vue.js covering its core concepts, features, and how to get started building modern web applications..

- Free

- January, 14th 2026

- 13

Flutter – API Integration with JSON Parsing and UI

- Free

About Instructor

Categories

Categories